The CSEET course is the entry-level examination for individuals aspiring to become Company Secretary (CS) in India

Executive serves as a continuation of the foundation laid in the CSEET and consists of seven subjects divided into two groups

Professional Level represents the culmination of a candidate's journey towards becoming a qualified Company Secretary.

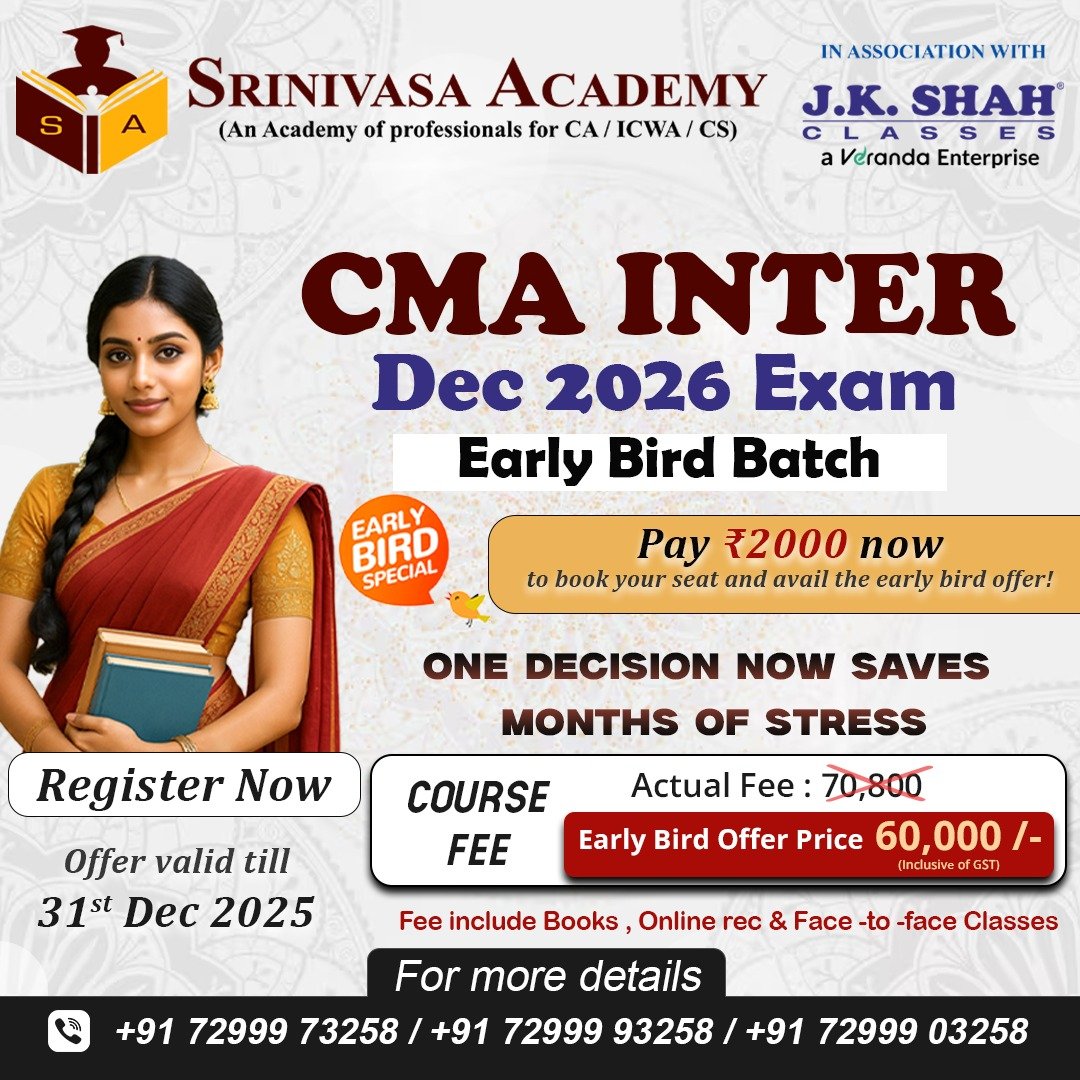

The Company Secretary Executive Entrance Test (CSEET) classes by Srinivasa Academy are held in:

1. Anna Nagar

2. Ashok Nagar

3. Tambaram

Srinivasa Academy provides the best coaching for CSEET pursuants by its state-of-the-art infrastructure and excellent faculties to enhance their learning.

The Company Secretary Executive Entrance Test (CSEET) is an entrance examination conducted by the Institute of Company Secretaries of India (ICSI). This exam is a prerequisite for students who wish to pursue the Company Secretary (CS) course. Here are the key details about CSEET:

ELIGIBILITY:

1. Educational Qualification: Candidates must have passed the 10+2 examination or an equivalent examination. Graduates and postgraduates are also eligible to apply.

2. Age Limit: There is no upper age limit for appearing in the CSEET.

Exam Structure:

CSEET comprises four papers, each designed to assess specific skill sets:

1. Business Communication: Focuses on effective communication skills in a business context.

2. Legal Aptitude and Logical Reasoning: Tests understanding of legal principles and logical analysis.

3. Economic and Business Environment: Evaluates knowledge of economic concepts and the business environment.

4. Current Affairs and Presentation & Communication Skills: Assesses awareness of current events and proficiency in presentation and communication.

The examination is conducted online through a remote proctored mode, allowing candidates to appear from their chosen location.